Canada Post regularly offers e-commerce merchants access to unique data, trends and resources. Now, with partners like Demac Media in the mix, you can expect even more resources and articles designed to boost your operation’s effectiveness and stimulate new growth.

Built for Canada’s online merchants

The Canada Post Shipping Solutions blog is a resource for online retailers that highlights cutting edge research, practical know-how and guest experts. Recent topics include:

- Returns: Merchant nightmare or a golden opportunity to build customer loyalty?

- Is online grocery the rising star on Canada’s e-commerce horizon?

- Get ahead: parcel pickup helps your online store operate more effectively

Demac Media puts the e-commerce numbers in context

Demac Media’s Quarterly eCommerce Benchmark Reports help online retailers see how their numbers stack up with their peers. They’re designed to help you prepare for the quarter ahead. The company’s most recent release reveals:

- Paid Search trumps Direct Search in Q1 of 2016 as the top earning acquisition channel

- Interactive platforms like Youtube drive social commerce revenue in 2016 for retailers.

- The decision to purchase continues to be shaped between devices for consumers.

Get the full report from Demac Media.

A sampling of Canada Post insights: Millions of deliveries give us a unique view of what’s happening in Canadian e-commerce

Our partnership with thousands of online merchants, delivering the majority of B2C parcels in Canada, generates unique insights and provides a holistic view of the nation’s e-commerce landscape. Here’s what stood out during 2015:

E-commerce grew at a rate of 15 per cent year-over-year

Fuelled by a maturing online shopper base who are increasingly moving their retail spend online, Canadian e-commerce continues to showcase consistent double-digit growth.

Steady growth continues in major urban markets like Vancouver, Toronto and Montreal, driven by an increasingly experienced online shopper base.

What should you watch for in 2016? Emerging secondary markets where customers are adapting rapidly to online shopping, as seen in 2015 growth pockets like the Prairies and Atlantic regions.

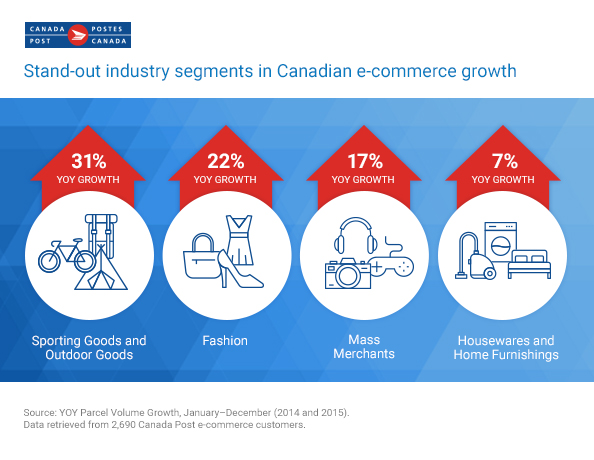

Traditional segments like fashion and mass merchant still show impressive growth, but emerging segments like sporting & outdoor goods and housewares & home furnishings reveal that Canadians are opening their wallets to a wider range of products as they become more comfortable shopping online.

The big story from 2015: Seasonal shopping has moved online

It looks like consumers are less interested in braving the lineups at brick-and-mortar stores during traditional big shopping events like Back to School, Black Friday and Christmas. In 2015, merchants recognized this trend, offering more online promotions and beefing up their fulfillment operations.

Canadians adopted the American Cyber Monday sale with enough gusto to turn the retail event into Cyber Week.

During 2015’s Cyber Week, Canada Post recorded a 32 per cent YOY increase in parcel volumes. And 2015’s Cyber Week parcel volume was 65 per cent higher than the previous week’s – suggesting that shoppers waited to buy in anticipation of better discounts during Cyber Week. It’s safe to say that this monumental week officially kicks off the start of 2015 holiday shopping season.

Future forward

It’s safe to say e-commerce has become part of the normal shopping mix for the majority of Canadians, no matter where they live or what they want to buy. Online retailers can leverage Canada Post’s exclusive insights as they focus on strategies to tap into this growth in 2016 and beyond.

Source: YOY Parcel Volume Growth: January – December (2014 and 2015). Data retrieved from 2,690 Canada Post e-commerce customers.